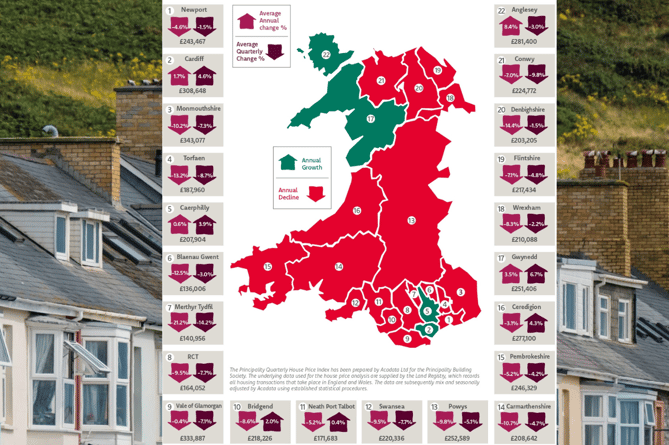

CEREDIGION has the fifth highest house prices in Wales – more than £40,000 above the national average.

Latest figures released by the Principality Building Society show house prices in Ceredigion rose by 4.3 per cent during the last quarter, but were down 3.1 per cent on the previous year.

The average home in Ceredigion now costs £277,100, almost double the average price in Blaenau Gwent.

The average house price across Wales currently stands at £234,086.

Gwynedd has also recorded a rise in house prices, with a 6.7 per cent leap in Quarter Four (October – December) and 3.5 per cent rise annually.

The average price of a home in Gwynedd how stands at £251,406.

Principality’s report shows that Carmarthenshire is one of six local authorities in Wales to record a double-digit price fall when compared to the same period the previous year, down 10.7 per cent annually and 4.7 per cent quarterly to an average house price of £208,642.

House prices in Pembrokeshire have fallen by 5.2 per cent annually and 4.2 per cent quarterly down to an average price of £246,329.

Powys has recorded a 5.1 per cent drop in the quarter and 9.8 per cent drop annually, with the average house price standing at £252,589.

Across Wales, the average price of a home has fallen to £234,086 at the end 2023. This is down 2.2 per cent on the quarter and 6 per cent - or £15,000 - when compared to the same period the previous year when the peak price of £249,076 was recorded.

Despite this being the largest year-on-year decline of Wales’ average house price since the aftermath of the Global Financial Crisis in 2009, house prices remain 25 per cent higher than five years ago.

Shaun Middleton, Head of Distribution at Principality Building Society, said: “The housing market in Wales has been through a difficult period and given the continued squeeze on the cost of living alongside the higher cost of mortgages - as households came off much lower fixed rates - it is little wonder that some have forecast continuing price falls in 2024, followed by a recovery in 2025.

“However, there are some positive signs including lower inflation and an expectation that the Bank of England rate has now peaked at 5.25 per cent and will fall during 2024. Indeed, financial markets are pricing in several rate cuts, bringing the BoE rate down to 4% later in the year. Mortgage markets have already moved, with lenders cutting rates quite significantly as competition intensifies, and we might expect that to continue.”

There were around 9,700 transactions in Wales at the end of 2023, just a slight drop on the previous quarter but down by a fifth on a year ago. Although all property types have experienced weaker sales, detached properties - down 27 per cent - continue to trail significantly behind other property types. As in many other parts of the UK, the pressures facing the housing market has had an impact on demand and activity levels. For Wales, quarterly sales transactions have declined year-on-year through the whole of 2022 and 2023.

Shaun continued: “Consumer confidence is becoming less negative, and the same is true of surveyor respondents to the latest RICS Wales housing market survey. More instructions are coming into the market and there is a sense that activity will increase, and on the back of that, prices might stabilise. Some analysts for the overall UK market are now suggesting that while the first quarter might still see prices in negative territory, there will be a steady improvement across the year.

“Without doubt, there will be challenges ahead, but the outlook for 2024 is more of an improving view than it was. Potentially, UK Government Budget measures (due 6 March 2024) might seek to stimulate market activity which would add further momentum, and of course housing will loom large in the manifestos being readied for the approaching General Election when it is called. In summary, it is an improving picture for 2024.”